Investors

Institutional investors and HNWIs investing in SEIS or EIS opportunities.

We've worked with 420+ Companies in the World

SEIS EIS

Backing Breakthroughs sectors with Technology

SEIS EIS

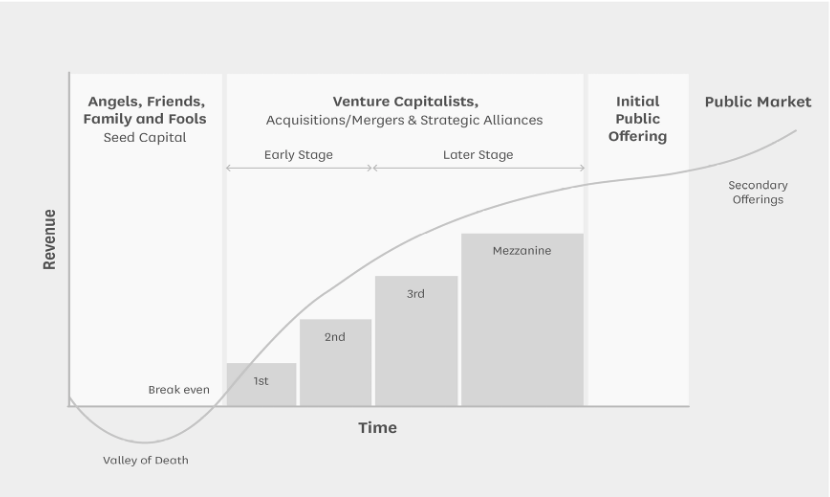

SEIS (Seed Enterprise Investment Scheme) and EIS (Enterprise Investment Scheme) are government-backed initiatives in the UK designed to encourage investment in early-stage and growth-stage businesses by offering generous tax incentives to investors.

Under these schemes, investors can receive income tax relief, capital gains tax deferrals, and loss relief, significantly reducing their financial risk. SEIS is targeted at very early-stage companies and offers up to 50% income tax relief on investments up to £100,000 per tax year. EIS applies to slightly more established companies and offers 30% income tax relief on investments up to £1 million (or £2 million if at least £1 million is invested in knowledge-intensive companies).

For startups and growing businesses, SEIS and EIS make raising capital more attractive by opening doors to angel investors, HNWIs, and institutional backers who benefit from these schemes. For investors, it’s a way to support innovation and entrepreneurship while enjoying substantial tax advantages.

Illustration

If you invest £100,000 under SEIS or EIS, here’s how the tax relief and potential benefits break down:

SEIS (Seed Enterprise Investment Scheme) — for very early-stage companies:

Income Tax Relief:

Up to 50% → You can reclaim £50,000 off your income tax bill.

Capital Gains Tax (CGT) Exemption:

If the shares are held for at least 3 years, any gain on disposal is tax-free.

Capital Gains Reinvestment Relief:

You can claim 50% CGT relief on other gains if reinvested in SEIS.

Loss Relief:

If the company fails, you can offset your net loss against income or capital gains.

Example: If you lose the full £100K, your actual loss after relief could be as low as £27,500.

EIS (Enterprise Investment Scheme) — for slightly more mature businesses:

Income Tax Relief:

30% → You can reclaim £30,000 off your income tax bill.

CGT Exemption:

After 3 years, profits from selling shares are tax-free.

CGT Deferral:

You can defer tax on other gains by reinvesting them into EIS shares.

❌ Loss Relief:

Similar to SEIS, losses can be offset. Your actual loss might be as low as £42,000 on £100K.

Summary Comparison on £100K Investment

SEIS EIS Income Tax Relief £50,000 (50%) £30,000 (30%) CGT Exemption Yes (after 3 years) Yes (after 3 years) CGT Deferral 50% of reinvested gains Full deferral

Loss Relief Yes Yes Net Risk Exposure* ~£27,500 ~£42,000

*Assumes no return and full use of tax relief.

Why Choose Us

Committed to The Growth Journey

Priority Process

Our priority process has helped founders secure $33 million in funding and achieve a $750 million exit to BlackRock.

Product Marker Fit

Its our business to discover the Product Market Fit for the problem you are solving.

Extensive Network

Our network supports your companies growth…

Investment Updates

We provide regular updates on the investment’s progress.

Institutional investors and HNWIs only

HNWI is an individual with £300k+ in household income and/or £3m+ in assets.

Traditional Founders

We are a Home for founders with No succession plan

London Term Holds

We acquire businesses from sellers who don’t have a succession plan in place. We hold these assets for the next generation.

Co-invest

We are the lead sponsor and welcome participation from institutional investors, family offices, and syndicate groups — provided they meet high-net-worth individual (HNWI+) criteria.

Our Team

Your Partners in Growing your Equity

Testimonials

What Our Partners Say About Us

We’re proud to work alongside visionary founders, operators, and innovators. Here’s what some of them have shared about their experience partnering with us.

Subscribe Our Newsletter To Get Updates

Madison Carter Ventures incubates, builds, and acquires businesses with a technology focus. Beyond capital, we provide hands-on operational and strategic support to help ventures scale and generate revenue. We are sector-agnostic and especially interested in solutions addressing critical challenges of the new era.

Quick Links

Social Media

Information

xxx 7xxx xxxx

hi@madisoncaterventures.com

London